Step One

The LGBTQ+ community faces discrimination in the halls of high finance – but change is coming

By Andrew Brooks

Christiane Wherry

Naoufel Testaouni

The representation of the LGBTQ+ community in business leadership has made great strides in recent years. According to a recent study by Deloitte LLP in collaboration with Canada’s Gay and Lesbian Chamber of Commerce (CGLCC) there could be as many as 100,355 LGBTQ+ owned, operated and controlled companies in Canada.

But the same study, Business Survey Summary & Analysis, published in May 2021, also found that the single greatest challenge among LGBTQ+-owned businesses is getting access to financing. Fully one-fifth of LGBTQ+ business owners identified access to financing as their biggest hurdle. While it’s risky to endorse stereotypes, it seems from anecdotal evidence that the persistence of the toxic masculinity that has become all too familiar in fictionalized portrayals of the venture capital industry continues to play a real-world role in shutting LGBTQ+ business owners out when they seek investment.

“We are historically a community that has faced discrimination,” says Naoufel Testaouni, co-founder and CEO of QueerTech, a group dedicating to queering the tech ecosystem. Testaouni believes that many members of the LGBTQ+ community have in effect been compelled to strike out on their own as entrepreneurs because discrimination has closed off more conventional career options at existing organizations.

That’s not the only downside. “There’s also a lack of trust between venture capital, industry associations, corporations and the LGBTQ+ community as these people have left or been fired because of who they are,” Testaouni says. “So when you look at the venture capital and finance industries, they’re very ‘macho’ dominated, and I think a lot of queer people have just not looked at their options in that world.”

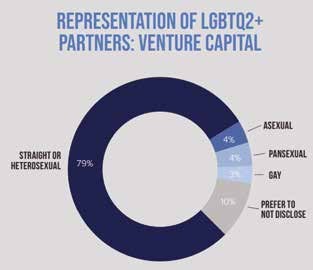

Source: CVCA/Diversio, “State of Diversity & Inclusion,” Nov. 2021

While the Deloitte/CGLCC study produced hard evidence that anti-LGBTQ+ discrimination is a real problem when it comes to securing venture financing, data collection on the challenge and its possible remedies is still in the early stages. As this went to press, QueerTech was about to release its own study on the tech industry, including gaps and challenges in the financing funnel.

Meanwhile, at the end of last year the Canadian Venture Capital & Private Equity Association (CVCA) released its State of Diversity & Inclusion 2021 report, co-published with Diversio, a firm that specializes in gathering diversity-related data. The report included data on the representation of LGBTQ+ partners in the Canadian venture capital industry. Among those who were surveyed, 10.3 per cent identified as LGBTQ+, which is a 20 per cent higher degree of LGBTQ+ representation than the 8.5 per cent of the Canadian financial sector overall.

Interestingly – albeit not too surprisingly – afurther 10 per cent chose not to disclose their sexual orientation. As the report noted, this suggests a persistently strong level of discomfort about being ‘out’ in the Canadian venture capital workplace. On the plus side, it also suggests that the real level of LGBTQ+ representation in that workplace is substantially higher than the 10.3 per cent who were comfortable disclosing their sexual orientation.

For Christiane Wherry, CVCA’s vice president, research and product and head of D&I, that battle for representation is “step one.” “With more [LGBTQ+] investors in the system, they feel comfortable, they feel safe, they can be true to themselves,” she says. “The next step would be trickling down investment decisions to also emphasize the diversity of the groups that are receiving investment. But it’s a gradual change, and it starts from having more representation and having more investors able to be true to who they are.”